The Project

"How might we create a human-centered & AI driven approach to resolve consumer debt?

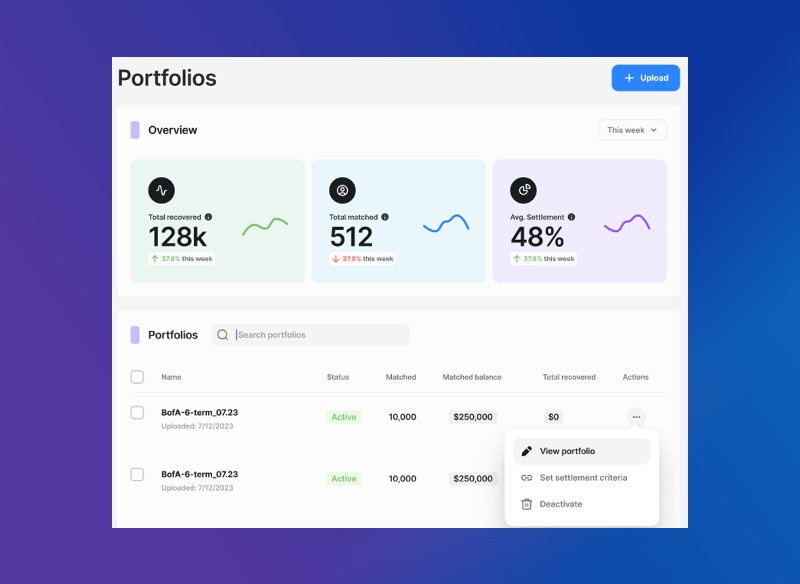

The delivered solution: I was responsible for building an enterprise grade B2B software 0 to 1 that lenders such as Wells Fargo and Chase utilize to service and recover post-charge off debt when working with Relief App users.

The Relief Model

The team built a technology-forward approach on debt relief that offers an end-to-end experience for both Consumers and Creditors/Collectors.

Debt Collection - The Current State

The debt resolution landscape has long been broken, plagued by adversarial processes and detrimental experiences for both consumers and creditors. Current debt settlement models have led to poor outcomes – consumers struggle to navigate predatory systems while creditors recover only 10-20% of owed debt on average. There is a clear need for an innovative solution to repair this fractured system. Relief aimed to be the pioneer to drive this change. As a fintech startup, our mission was to leverage technology to disrupt outdated practices and create mutually beneficial outcomes for consumers and creditors.

To understand the landscape, I conducted extensive discovery over 3 months including 25 in-depth interviews with business leaders, consumer focus groups, and workshops with major creditors like Bank of America and Wells Fargo. Our research revealed clear needs for a flexible, digital-first solution that could improve user experiences and recovery rates.

It was evident that an integrated platform approach could transform debt resolution.

However, as an industry first-mover we faced immense challenges – from compliance ambiguity to complex system integrations. As Principal PM, I was tasked with leading our product team through uncharted waters to make this vision a reality.

Product Discovery Approach

As the lead Product Manager, I led the problem discovery phase by deeply researching the current debt resolution landscape from multiple perspectives. Our research uncovered a broken system failing both consumers and creditors.

Key pain points:

- Consumers struggled with unclear processes, harassment tactics, and lack of affordable resolution options

- Creditors faced low recovery rates (~20%), reliance on manual processes, and misaligned incentives

This research enabled us to outline a future ideal state centered on flexibility, transparency and collaborative problem solving:

- For consumers, the ideal was flexible repayment plans based on affordability, debt transparency, and tools to proactively resolve balances

- For creditors, the ideal was increased recovery rates through automation, account insights, and predictive modeling

With this vision defined, I worked closely with our CEO and Head of Design to shape an integrated product portfolio that solved core problems identified in the current state:

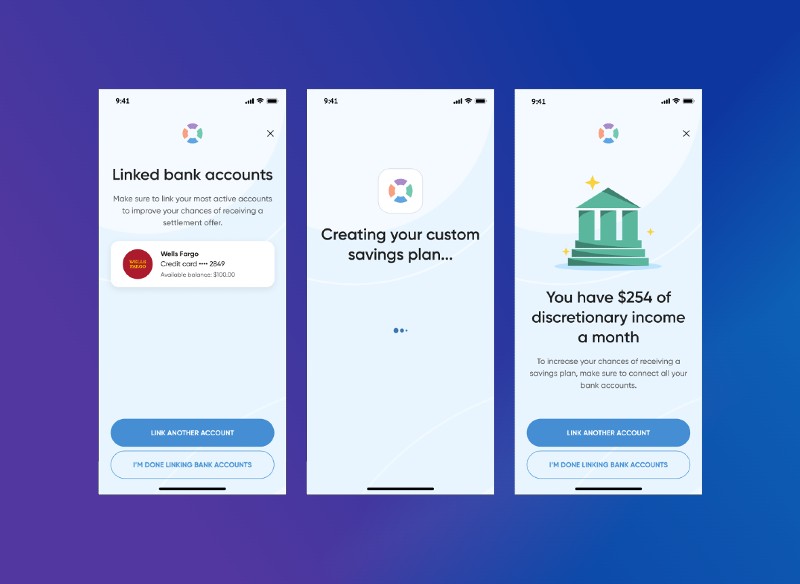

- Priority #1: Develop B2C app (Relief App) to empower consumers with education, savings tools, and affordable repayment plans

- Priority #2: Build B2B software (Relief Recover) to provide creditors with account management, analytics, and digital settlement

- Priority #3: Connect products through payment rails and data integration to enable seamless experiences

By deeply understanding root causes, we crafted a product strategy to disrupt ineffective practices. Our solutions aimed to move the ecosystem towards a more collaborative, transparent and mutually beneficial debt resolution system.

Laying the foundation:

Building The Product Development Engine

Being one of the first-string of hires at Relief meant I had to build our Product Design & Development Lifecycle from the ground up. This included instituting agile principles, becoming research-led, and focusing on human-centered design.

Agile Ceremonies

& Sprints

Product Requirement Documents (PRDs)

Automated Workflows & Status Updates

Product Roadmaps & Backlog

Ongoing User Research

Compliance & Fraud Mitigation

Overcoming Key Challenges

While thorough planning paved the way for success, any large-scale transformation inevitably surfaces obstacles. During the 6-month development timeframe, we faced numerous challenges, which I’ve outlined below and the remediations I put in place to mitigate:

- Challenge #1: Resource constraints for design and engineering who were juggling B2C and B2B priorities. We mitigated through tighter sprint planning.

- Challenge #2: Tight budget limits required creative solutions like leveraging internal tools and documentation to lean on existing multi-platform API integrations.

- Challenge #3: Scope creep from new regional requirements needed careful prioritization to prevent feature bloat.

- Challenge #4: Unanticipated effort for integrating new front-end components and design features, global site analytics and other core infrastructure modifications caused schedule overruns.

To tackle issues proactively, I led bi-weekly risk reviews, tighter scoping of upcoming sprints, and open communication with team leads. My focus on transparency helped maintain trust and morale despite hurdles.

In the end, we delivered a stellar MVP that met our core goals within 2 months of timeline. Post-launch, we continued improving the platform and addressing internal stakeholder priorities.

The experience reinforced that even seasoned PMs encounter blindspots. While I excelled at mitigating risks, I learned to further strengthen contingency plans for large programs. Our shared success overshadowed the roadblocks along the way.

Product Discovery

We built a first of its kind enterprise financial product 0 to 1 based on research and data. Then paired it with a companion B2C App.

Key Focus Areas

We invested heavily in UX and Data Science to deliver exceptional value and advanced analytics to both user groups.

Revenue Generation

The launch of Relief Recover enabled our startup to become operational. We exceeded revenue targets by 80% in the first quarter after launch

Debt Relief

B2C App

B2B Software

Revenue Models

Analytics

Design Systems

AI/ML

Startup

Conclusion

When I joined Relief as their PM, I recognized the immense challenges we faced as innovators in an antiquated industry. However, by embracing ambiguity and leading with transparency, we mitigated risks to build a first-of-its-kind solution.

Now nearing the finish line, our work has pioneered how human-centered fintech can positively transform debt resolution. Relief App will reach general availability this quarter, empowering consumers to resolve debt with dignity. Meanwhile, Relief Recover is 80% complete and positioned to drive step-function improvements in creditor recovery rates.

This achievement was only possible through collaboration – across Product, Engineering, Design, Finance, Operations and our partners. By maintaining alignment, even as new constraints emerged, we turned lofty ambitions into reality.

As we look ahead, I am energized by the opportunity to scale our platform and expand its possibilities. The future is bright when we come together and commit wholeheartedly to enabling mutually beneficial outcomes.

Though the terrain was difficult, we persisted. I could not be more proud of the products we built and the positive impacts we will create for consumers and businesses alike.